حول 中国建设银行

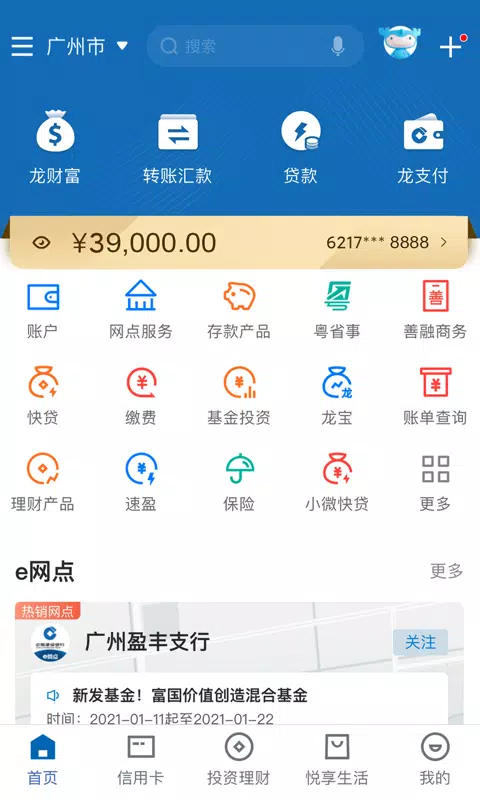

Introduction to China Construction Bank Mobile Banking Platform 5.0

Revolutionizing Financial Services with Smart Tech Integration

China Construction Bank (CCB), a leading financial institution in China, has recently unveiled its mobile banking platform 5.0, designed to enhance user experience through cutting-edge technology integration. This platform aims to offer a comprehensive, intelligent, secure, and convenient mobile banking solution that caters to diverse customer needs.

Key Features and Enhancements

-

Optimized Investment Experience: The platform now offers an improved view of your investment portfolio, featuring a more intuitive interface. Users can easily access and manage their holdings, with enhanced features like automatic alerts for nearing expiration dates on investments. Additionally, the transaction limits for fund purchases and redemptions have been refined for better user guidance.

-

Enhanced Loan Application Process: The loan application process has been streamlined into an "Application Progress" feature, providing a comprehensive overview of various loan products' statuses, from submission to approval. This ensures transparency and efficiency in managing loan applications.

-

Smart Channel Navigation: The platform introduces a dynamic and personalized experience by integrating AI-driven recommendations across five key channels: Personal, Loans, Cards, Investments, and Services. The channel's layout adapts to each user's behavior, offering a tailored experience.

-

Intelligent Service Delivery: With features like smart search, voice commands, guided navigation, and personalized recommendations, users can enjoy a seamless, intuitive journey through the app. These tools are designed to anticipate user needs and provide proactive assistance throughout the banking process.

-

Advanced Security Measures: CCB 5.0 boasts robust security enhancements, allowing users to customize their authentication methods. From biometric verification to complex password policies, the platform ensures protection against unauthorized access while maintaining user convenience.

-

Refined Account Management: The account services have been overhauled with a sleek design, improved card presentation, and a user-friendly interface. Enhanced features include quick access to account information and streamlined management of account details.

-

Efficient Transfer Functionality: Transferring funds is now more accessible than ever, with a streamlined top-bar menu enabling swift access to transfer options. Users can easily track their transfer history, enhancing transparency and accountability.

-

Real-time Communication: Updates and notifications are delivered directly to the phone's notification center, ensuring that users stay informed about their bank transactions and promotional offers without missing any important updates.

-

API Openness and Customization: The platform supports an open API ecosystem, offering developers access to eight major categories of APIs. This facilitates the integration of personalized services, making banking solutions more accessible and adaptable to individual needs.

-

Accessibility for All: Recognizing the importance of inclusive service delivery, CCB 5.0 incorporates technologies like image recognition and speech synthesis to assist visually impaired users. This feature allows users to navigate the app with ease, reading out information based on touch, ensuring accessibility for all segments of society.

Conclusion

China Construction Bank's mobile banking platform 5.0 represents a significant leap forward in digital banking, leveraging the power of artificial intelligence and advanced technologies to create a user-centric, secure, and accessible banking experience. This platform not only enhances traditional banking services but also pushes the boundaries of what is possible in mobile finance, making it a must-have tool for modern banking needs.